Struggling to keep up with your money? Say hello to the future of easy money management with AI!

These smart tools help you plan your budget, save, and invest without the headache.

Learn about the top AI financial helpers that make managing money a breeze, guiding you to your money goals quicker than you thought possible.

Table of Contents

📈 From Budgeting to Investing: AI Tools Every Business Needs

To best serve your business’s financial needs, we’ve categorized these AI tools based on their core functions in finance, ensuring you find the perfect match for every aspect of your business’s money management

🪄 Zapliance : Best for Cash Recovery

Zapliance uses smart AI to help businesses find and get back lost money. It looks through all the money transactions to spot mistakes or times when the business didn’t get paid enough.

This AI makes checking lots of data quick and easy, so businesses can find more money they didn’t know they could get back.

This helps businesses have more cash on hand, makes their money matters clearer, and helps them make better choices with their money.

Zapliance is like a detective for your business’s money, making sure you’re not missing out on cash you should have.

Must Read:

⏩ #4 Unique Features

📍 Automated Data Analysis

Zapliance’s AI excels in sifting through massive volumes of transactional data automatically. This feature allows it to identify inconsistencies, errors, and opportunities.

For cash recovery that might be missed by human eyes, ensuring no stone is left unturned in the search for recoverable funds.

📍 Real-Time Insights

The AI provides real-time insights into financial transactions, offering businesses the ability to act swiftly on potential cash recovery opportunities.

This immediacy ensures that businesses can address issues as they arise, enhancing cash flow and reducing financial risks.

📍 Predictive Analytics

Zapliance’s AI uses predictive analytics to forecast future cash recovery opportunities based on historical data trends.

This capability allows businesses to anticipate and strategize for financial recoveries, improving their financial planning and decision-making processes.

📍 Smart Learning

Its AI gets better over time because it learns from past money transactions. This means it gets really good at spotting where you might be able to get money back, just like learning from mistakes to do better next time.

👎🏻 2 Improvement Points

📍 Understand More Languages and Money Types

If Zapliance could understand more languages and different types of money from around the world, it would be super helpful for companies that work in many countries.

This would make it easier for these companies to use Zapliance to find lost money, no matter where they are or what language they speak.

📍 Guess Future Money Mistakes

It would be great if Zapliance could not only find lost money but also help businesses see where they might lose money in the future.

This way, businesses could fix problems before they happen and keep their money safe.

🪄 Finchat.io : Best AI for Investment

Finchat.io is like a smart helper that makes investing easy. It looks at a lot of information about stocks and investments to give you advice that fits just right with what you want and how much risk you’re okay with.

Imagine it’s like a friend who knows a lot about making money grow and can tell you the best places to put your money.

This smart helper keeps an eye on how the stock market is doing, understands tricky financial stuff, and even guesses what might happen next with prices.

With Finchat.io, you can make smart choices about your money without having to spend lots of time studying it yourself.

It’s like having a mini-expert with you all the time, helping you make your money bigger.

Must Read:

- Venmo Review: Is It A Safe Payment & Crypto Platform?

- ZenLedger Review: Is This Taxing Platform Safe and Secure?

⏩ #4 Unique Features

📍 Future Guessing

Helps in guessing what might happen with your money in the future, using smart computer tricks to look at past trends and what’s happening now.

This could help you decide where to put your money for a good chance to see it grow.

📍 Safety Check

A special feature that looks at how risky an investment might be, checking things like how prices go up and down and what’s happening in the world.

It helps make sure you’re not taking on too much risk, keeping your money safer.

📍 Copy the Pros

This would let you peek at what successful investors are doing and get suggestions on how you might do something similar. It’s like learning from the best and using their smart moves for your own investments.

📍 Mind Tricks Alert

A feature that helps you understand how your own feelings and thoughts might be affecting your investment choices, like if you’re being too cautious or taking a big risk without realizing it.

It helps you think clearer and make smarter choices.

Must Read:

- Cash App Review: Is This A Safest Payment Platform? (Truth)

- PayPal Review: Is It The Best Payment Platform?

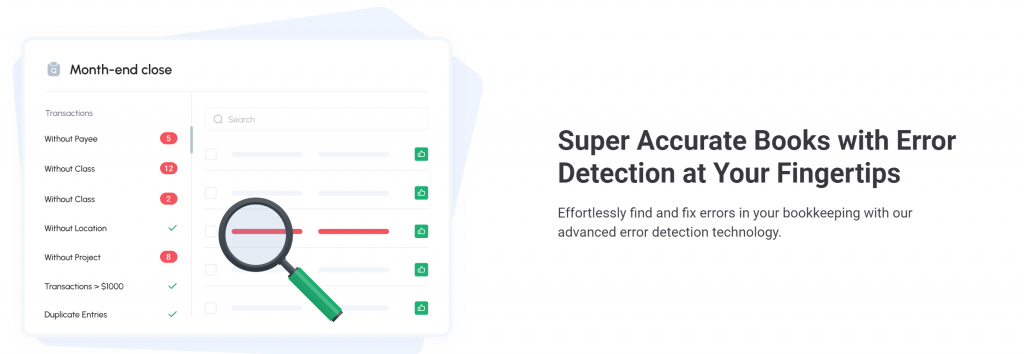

🪄 Booke.ai: Best For Bookkeeping

Booke.ai is like a smart helper for keeping track of your business money. It automatically sorts out all your sales and bills, putting them in the right places without you having to do it yourself.

Imagine it as a super-smart friend who is really good at organizing and never mixes things up. It can also read receipts and turn them into neat digital notes, so you don’t have to type everything in.

Plus, it shows you how your business is doing money-wise, anytime you want to check. This means you get to spend less time worrying about numbers and more time making your business better.

Booke.ai makes keeping your money records easy and stress-free.

⏩ #4 Unique Features

📍 Snap and Sort Receipts

Just take a picture of a receipt, and Booke.ai will figure out what it’s for and put it in the right spot in your books. No need to type anything in!

📍 See Your Money Now

With Booke.ai, you get a special page that shows you how your business money is doing right now. You can see what’s coming in and going out without waiting or guessing.

📍 Guess Your Future Money

Booke.ai can help guess how much money you’ll have later based on what you’ve been earning and spending. This way, you can plan better for things you need to pay for soon.

📍 Matching Game

It can automatically check your bank stuff against your books to make sure everything matches up. This means less headache trying to figure out if all your records are right.

👎🏻 2 Improvement Points

📍 Figuring Out Complicated Money Stuff

Right now, Booke.ai does a great job with simple money tasks, but it gets a bit confused with trickier things.

Like, if you spend money in different ways or in different countries, it might not always know how to handle that. Making it smarter about these complicated situations would help a lot.

📍 Letting You Make It Yours

While Booke.ai is great for basic bookkeeping, sometimes you want it to do things a special way for your business.

If it let you set up your own rules for how to organize your money or create your own categories, it would be even more useful because it could work just the way you need it to.

🪄 MindBridge.ai: Best For Financial Risk

MindBridge.ai is like a smart helper that uses AI to keep your business safe from money problems. It looks at lots of data about the market and economy to guess what might go wrong in the future.

Think of it as having a crystal ball that warns you if a financial storm is coming, so you can make smart moves to protect your money.

It also gives advice on how to dodge or lessen those risks, kind of like showing you the best path to take in a tricky situation.

With MindBridge.ai, businesses can be ready for surprises and make better choices, making sure they stay strong even when things get shaky.

It’s a great tool for anyone who wants to keep their finances safe and sound.

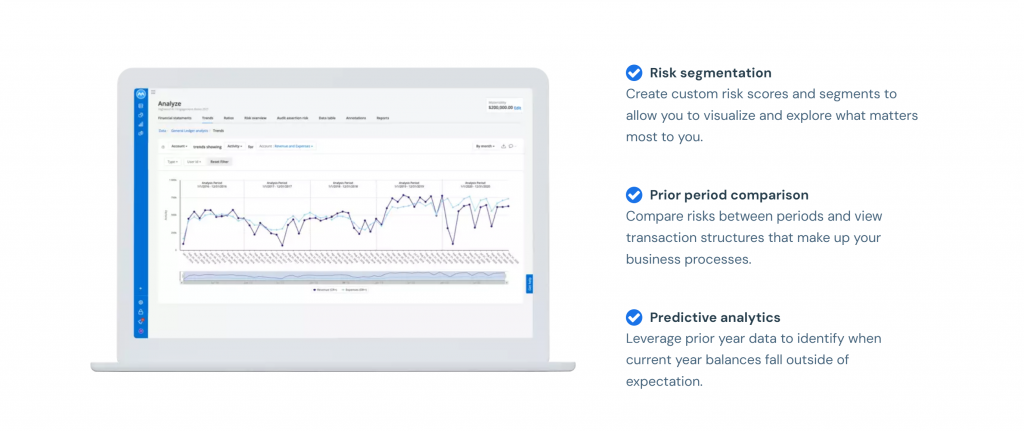

⏩ #4 Unique Features

📍 Spotting Weird Stuff

It’s like having a super-smart friend who can quickly find anything odd with your money, such as mistakes or signs that someone might be trying to trick you. This helps you fix things before they become big problems.

📍 Risk Scores

MindBridge.ai gives a “risk score” to transactions, kind of like a danger rating. This helps you figure out which transactions need a closer look first, so you can focus on the most important issues.

📍 Easy-to-understand Dashboards

It has special screens that show you everything about your business’s money in a way that’s easy to understand. You can see what’s going well and what’s not, helping you make smart decisions.

📍 Learning as It Goes

The more you use MindBridge.ai, the smarter it gets. It learns from your business’s money patterns and gets better at warning you about future risks, helping you stay one step ahead.

👎🏻 2 Improvement Points

📍 Better for Small Businesses

Right now, MindBridge.ai is great at looking at lots of data, which might make it miss some special things about smaller businesses.

It could try to understand these small businesses better, so it can give advice that fits just right for them.

📍 Letting You Make It Yours

Although it’s smart at guessing risks, MindBridge.ai doesn’t let businesses easily change how it makes these guesses to better match what they’re worried about or what’s special about their type of business.

If businesses could tweak it to better fit their needs, it might do an even better job of spotting problems.

🎯 From Recovery to Growth: AI Innovations in Business Finance

🤑 Zapliance: Great for Finding Lost Money

- How it Helps: It’s like having a detective for your business’s money. Zapliance searches through all your transactions to find mistakes or times you weren’t paid enough, helping you get that money back.

- Special Bits: It’s really good at checking lots of data quickly, giving updates as they happen, guessing where you might find more money, and learning from past transactions to get better over time.

📈 Finchat.io: Your Investment Buddy

- How it Helps: Think of Finchat.io as a friend who knows a lot about investing. It gives you advice on where to put your money based on how much risk you’re okay with, making investing less scary and time-consuming.

- Special Bits: It can predict what might happen with your investments, check how risky an investment is, let you learn from successful investors, and help you understand how your feelings might affect your investing decisions.

✍🏻 Booke.ai: Keeps Your Books Tidy

- How it Helps: Booke.ai organizes your sales and bills automatically, turning receipts into digital records easily. It shows you how your business is doing with money at any moment, making bookkeeping simple.

- Special Bits: You can just snap a picture of receipts to sort them, see your business’s money situation in real-time, guess future earnings and spending, and match your bank info with your books without the headache.

💀 MindBridge.ai: Watches Out for Money Risks

- How it Helps: MindBridge.ai is like having a crystal ball for your business finances. It looks at lots of data to warn you about potential money problems ahead, advising you on how to avoid or lessen those risks.

- Special Bits: It’s great at finding odd things in your transactions, gives each transaction a risk rating, makes it easy to see your financial situation, and learns from your business to get better at spotting risks.

These AI tools are like having a team of experts helping you with different parts of your business finances, from finding money you didn’t know you could get back to making smart investment choices, keeping your books tidy, and staying safe from financial risks.

🔥 Bottom Line

In short, AI tools like Zapliance, Finchat.io, Booke.ai, and MindBridge.ai are like super-smart helpers for businesses.

They make managing money much easier by doing things like finding lost cash, giving investment tips, keeping track of spending, and spotting financial risks before they’re big problems.

Each of these tools has special tricks that make them really good at what they do. But, just like anything else, there’s always a way to make them even better, like making sure they work great for small businesses or letting you customize them more.

As these AI buddies get smarter, they’ll be even better at helping businesses stay on top of their money game, making it easier to grow and succeed. With AI’s help, reaching financial goals can be quicker and simpler than ever.