Are you fed up with PayPal’s high fees and strict rules? 😤

You’re not the only one.🫵 Many people are looking for other ways to make and receive payments because PayPal can be expensive and sometimes freeze accounts unexpectedly.

Also, getting help from their customer service can be tough. Don’t worry, though! There are many other payment options out there that are cheaper, safer, and easier to use. 🔐

We’re here to guide you through the top alternatives to PayPal that offer a better deal for your money. Get ready to explore options that will make your online payments smoother and more hassle-free!

Table of Contents

Google Pay, Skrill, Venmo: Which One Suits Your Needs?

| Feature/Service | Google Pay | Skrill | Venmo |

|---|---|---|---|

| Transaction Fees | No fees for personal use; fees for businesses | Fees for transactions and currency conversion | 1% fee (min. $0.25 and max. $10) for instant transfer; free for standard transfer |

| Transfer Limits | Varies by country and type of transaction | Varies, higher limits for verified accounts | $299.99/week unverified, up to $4,999.99/week verified |

| User Interface | User-friendly, integrated with Google services | Simple, straightforward interface | User-friendly, social features |

| Security Features | Advanced security protocols, virtual account numbers for cards | Two-factor authentication, anti-fraud technology | Encryption, purchase protection for eligible items |

| Availability | Available in many countries | Global availability, with some restrictions | Primarily available in the United States |

| Supported Currencies | Depends on the country, and supports major currencies | Supports over 40 currencies | Primarily USD |

| Additional Features | NFC payments, integration with other Google services | Online shopping, cryptocurrency transactions | Social feed, joint accounts (Venmo Groups) |

Google Pay

Google Pay is a good choice instead of PayPal because it works well with other Google things you might use.

It’s easy to pay with your phone in stores or online. The app is simple to use, so you can see your payments easily.

You can also get special deals or money back, which PayPal doesn’t do much. Google Pay is also very safe, maybe even safer than PayPal, keeping your money and information secure.

So, if you like Google stuff, want easy payments, and like extra rewards, Google Pay could be better for you than PayPal.

📌#4 Unique Features

📍Works with Google Stuff: Connects easily with other Google things like Gmail and phones using Android. This means you can handle your money while checking emails or using your phone. PayPal is separate and doesn’t link up with these things.

📍Easy to Use: It is really simple to use. You can quickly see and manage your money. PayPal is also easy but might not work as smoothly with your phone’s other features.

📍Special Deals: Often gives you special deals like money back or discounts when you use it. PayPal doesn’t do this as much, so you might save more with Google Pay.

📍Keeping Your Money Safe: Both Google Pay and PayPal keep your money safe, but they do it differently. Google Pay uses the latest safety features like fingerprints or face scans on your phone. PayPal uses passwords and other common safety steps. Google Pay’s way might feel newer and more tied in with your phone.

🪄2 Improvement Points It Needs To Improve in Comparison to Paypal

- 📍Being Used in More Places: It needs to be accepted in more countries and by more stores and websites. Right now, PayPal can be used in more places around the world. If Google Pay wants to be as good as PayPal, it needs to work on being accepted in more places.

- 📍Better Help for Customers: Google Pay also needs to improve how it helps its customers. PayPal is really good at helping people when they have a problem, like when they need to get their money back or if something goes wrong. Google Pay should work on having better support for its users, especially when they need help quickly.

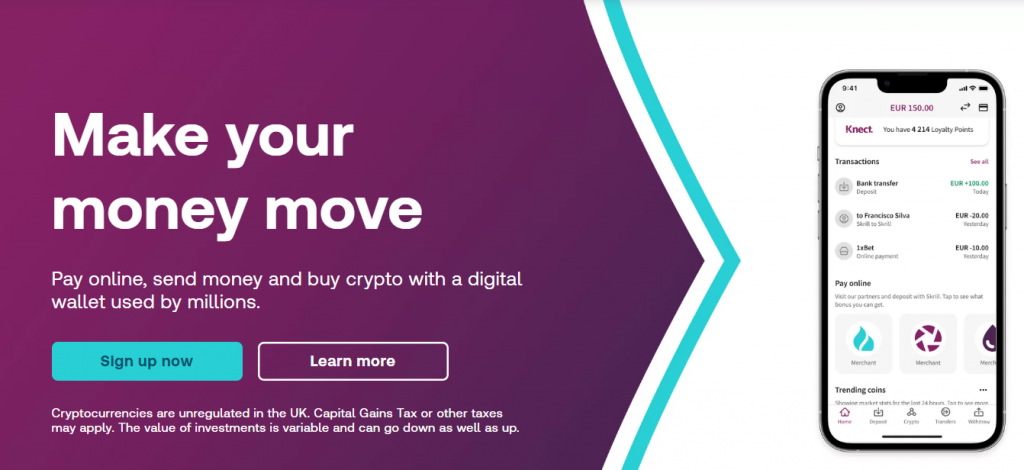

Skrill

Skrill is a good choice instead of PayPal for a few reasons. It often has lower fees, which means it can be cheaper, especially for people who deal with money from different countries.

The app is easy to use, making it simple to send and receive money. Plus, if you’re in Europe, you can get a free card to access your money directly.

Skrill is also accepted by many gaming and betting websites, which can be helpful if you use those sites. If you use Skrill a lot, they have a VIP program that gives you benefits like lower fees.

So, if you want a cheaper and easy-to-use option, Skrill might be better than PayPal for you.

📌#4 Unique Features

📍Free Card: If you live in Europe, It gives you a free card. This card lets you use your money right away without putting it in a bank first. It’s handy for quick access to your cash.

📍Good for Gaming and Betting: Many gaming and betting websites accept Skrill. If you use these sites, Skrill is a better choice than PayPal, which might not work on all of them.

📍International Transactions: Skrill is often more cost-effective for international money transfers than PayPal, making it a better choice if you frequently send money across borders.

📍Multi-Currency Wallet: Skrill allows users to hold and manage multiple currencies within their account, which can be useful for individuals or businesses dealing with various currencies.

PayPal may require separate accounts for different currencies, making Skrill more convenient in this aspect.

🪄Two Areas Where Skrill Could Get Better

- 📍Clear Fees: Skrill should make its fees easy to understand. People should know exactly how much they will be charged for using Skrill, so there are no surprises.

- 📍More Places to Use: Skrill can be used in more online stores and services. If they work with more websites, it will be more convenient for people to use it for their online shopping and payments.

Venmo

Venmo is like a cool alternative to PayPal. It’s great for sending money to friends and family, especially if you’re young and like using your phone. You can even chat and share what you’re paying for, making it fun. Venmo works well on your phone and smartwatch, which is super convenient.

But, remember, PayPal is like the older, more experienced sibling. It can do a lot more stuff, like paying for online shopping and business transactions. So, while Venmo is awesome for casual payments, PayPal is still the go-to for more serious money stuff.

#4 Unique Features

📍Social Fun: Venmo is not just for sending money. It has a social feed where you can add emojis and comments to payments. This makes it more than just a payment app – it’s a fun way to connect with friends and show your personality.

📍Easy Bill Splitting: Ever struggled with figuring out who owes what after a group dinner or trip? Venmo solves that. It’s super simple to split bills with friends using the app. This means less time doing math and more time having fun.

📍Venmo Card: Besides the app, It offers a physical debit card called the Venmo Card. You can use it in stores or online, just like any other card. It’s a great way to spend the money in your Venmo account without having to transfer it to your bank.

📍Cool for Young People: Young folks, like millennials and Gen Z, really like Venmo. Its trendy look and easy-to-use features make it a hit. It fits right into their social life, making it a go-to app for sharing costs and staying connected.

🪄Two Things Venmo Could Improve

- 📍Better Privacy: Right now, other people can see your payments on Venmo unless you change the settings. Many people don’t know how to do that. Venmo could make payments private from the start, or make it easier to understand how to keep your payments just between you and your friends.

- 📍Send Money Overseas: Venmo only works in the United States. It would be really helpful if you could use Venmo to send money to people in other countries. This would make Venmo more useful for people who have family or friends in different parts of the world.

💥Top 5 Tips for Choosing a PayPal Alternative

◾Look at the Fees Carefully

Different services have different costs. Some might be cheaper than PayPal when you send money, others when you receive it. Also, check if there are extra fees for things like moving money to your bank or converting between currencies.

◾Safety is Key

Your money and personal details need to be safe. Find a service that protects your account well. This includes strong passwords, steps to prevent unauthorized access, and measures to stop any kind of fraud.

◾Ease of Use is Important

The service should be straightforward and user-friendly. You don’t want to waste time figuring out how to send or receive money. A good service makes these processes quick and easy.

◾Good for International Use

If you’re dealing with people in other countries, choose a service that handles international transactions well. Some services offer better exchange rates or faster transfer times, which can be very helpful.

◾Responsive Customer Support

Make sure the service has a good support team. If something goes wrong or you have questions, it’s important to have quick and helpful customer service. This could be through a chat system, email, or a phone hotline.

🔥 Bottom Line

If you’re looking for something other than PayPal, there are good options out there. Google Pay, Skrill, and Venmo each have their own cool features.

Google Pay is great if you love Google products. It’s easy to use and has nice extras like special deals. But it needs to be used in more places and have better help for its users.

Skrill is a good pick if you send money to different countries because it’s usually cheaper. It also has a handy card you can use in Europe. But, Skrill should make its fees clearer and be accepted in more online shops.

Venmo is fun for sending money to friends and family. It’s easy and has a social side, where you can add emojis and comments. But it needs better privacy settings and the ability to send money outside the U.S.

When choosing one of these, think about how much they charge, how safe they are, how easy they are to use, if they’re good for sending money abroad, and if they have good customer service. Each one has good points and things they could do better. Your choice depends on what you need for your online payments.