The best online trading platforms provide exceptionally high levels of speed, quick processing, and an excellent research collection. a low-cost smartphone application providing mobile trading capability There are two types of trading platforms: commercial portals and prop systems. 🌐

Commercial websites, as the title indicates, are aimed at day trading and retail investors. 💵

These stand out for their simplicity of use and a slew of useful tools for shareholder teaching and science, such as news sites and maps. 🗺️

Table of Contents

📈 What is a Trading Platform ?

A trading platform is a technology that lets speculative investors to place deals and monitor their accounts via financial institutions. Trading platforms are frequently packaged with additional services like as real-time quotation, graphing instruments, status updates, and even premium analysis.

So here are the few popular platforms. 👇

E*TRADE

E*TRADE makes it simple to begin trading, commodities, managed funds, and more, whether you’re a novice or a seasoned investor. E*TRADE, a Morgan Stanley subsidiary, is an automated trading platform for investors.

The brokerage’s renowned technology enables customers to follow the success of their assets as well as other market news. E-Trade is expected to fulfil the demands of a wide range of investors, from novices to expert traders.

📌 Features

- Early buyers will profit first from the brokerage’s education and research services, as well as the brokers’ 24/7 customer support and hundreds of no-transaction-fee (NTF) accounts.

- E*TRADE distinguishes itself primarily by its educational tools, which assist you in investing your money regardless of which option you take.

🤑 Pricing plan

It has a monthly fee on $15 for trading.

Pros and Cons

Pros 👍

- A collection of in-depth articles and videos, as well as free analyst research and investment tools, is available.

Cons 👎

- It is not that cost effective.

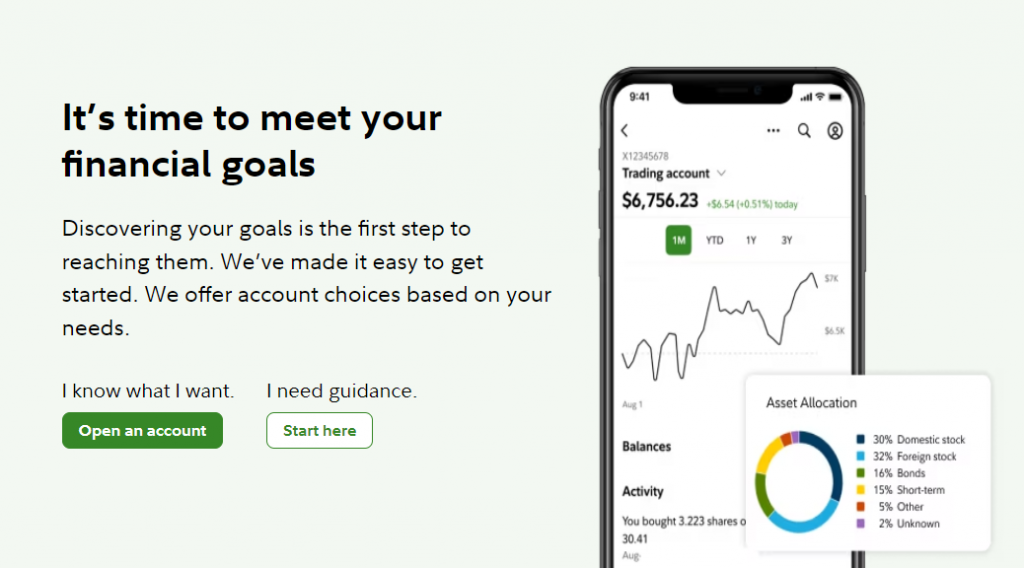

Fidelity

Fidelity Investments is a brokerage based in the United States that was created in 1946. It is overseen by top-tier regulatory bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) (FINRA).

📌 Features

- Fidelity is regarded as safe because to its extensive track record and regulation by top-tier financial regulators.

- Each transaction in foreign ordinary stock that is not qualified for Depository Trust Company will additionally incur a $50 fee. Accounts for retirement and non-retirement.

🤑 Pricing

Only Fidelity Brokerage Services LLC retail clients pay $0.00 commission on online U.S. equities transactions, exchange-traded funds (ETFs), and options (+ $0.65 per contract charge) in a Fidelity retail account. An activity assessment charge (ranging from $0.01 to $0.03 per $1,000 of principal) is applied to sell orders.

Pros and Cons

Pros 👍

- Most securities and brokerage services have low or no costs.

- A wide range of wealth management choices

- For simple investment strategies, consider using a robo-adviser.

- There are around 200 investment centres located throughout the country.

Cons 👎

- Fees for managed options and broker-assisted transactions are exorbitant.

- There is no support for futures or direct cryptocurrency trading.

TD Ameritrade

If you are a beginner trader who is not familiar with the online Forex trading industry, it is best to start by working only with ASIC-regulated brokers.

Yes, the best forex brokers offer various educational materials such as articles and videos to help you learn how to trade forex.

After testing 11 brokers and collecting 2816 data points, we found that TD Ameritrade has the best desktop trading platform, TD Ameritrade has the best web trading platform.

📌 Features

- As one of the largest online trading platforms, TD Ameritrade offers many first-class services, including research, data and information for stock and money management, and more.

🤑 Pricing

You’ll get industry-standard stock and ETF commissions, as well as industry-leading options contracts commissions, for as little as $0.50. Ideal for Options Trading TD Ameritrade is maintenance intensive, and offers intuitive trading tools and powerful investments.

It was revived as the top broker based on features important to individual investors, including trading fees, minimum accounts, free research, and many more features.

Pros and Cons

Pros 👍

- It is online trading has an original platform, but still offers trading on the most powerful and various platforms.

- It is the online trading platform that is recognized as one of the best forex brokers for its low transaction costs, zero commissions, and many trading options with the highest level of customer data security.

- If you want to be the best forex trader by trading commodities, cryptocurrencies, stocks, indices, and metals, it is online trading is a great opportunity

- As a trusted multi-asset broker, it provides traders with excellent customer service and an excellent overall trading experience with a great trading platform.

Cons 👎

- Discount brokers offer low commissions on exchanges and usually have web platforms or apps to manage your investments

- It does not offer a platform over the web, or you can use one of the desktops or mobile trading applications.

TradeStation

TradeStation tops the list with its powerful trader workstation platform, easy access to a large number of global markets, and extremely low transaction fees. This trusted platform differentiates itself from other online forex brokers by offering a wide range of compatible tools from third-party providers.

📌 Features

- The platform has everything you’d expect from an online forex broker, including detailed trading charts and tools, a powerful trading calculator, and real-time forex market sentiment information.

- In addition, TradeStation offers a wide range of educational and research resources for new traders, as well as a mobile application for its trading platform.

🤑 Pricing

TradeStation was the first online broker to remove fees and only offer $0 fees for U.S. stocks and ETFs, and it was also #1 on Benzinga’s

For mutual funds, bonds, international trades, short trades, etc. In addition to professionals, Interactive Brokers caters to casual investors with zero trades and Interactive Brokers’ intuitive web platform.

Pros and Cons

Pros 👍

- Whether you’re a novice investor or have been trading the markets since before the last recession, free stock trading platforms and apps offer a great opportunity to maximize your profits and make trading easy

- Easy and simple outlook.

- Ideal for Stocks and has good overall ratings.

- Interactive Brokers is a comprehensive trading platform that gives you access to affordable prices.

Cons 👎

- The platform is not so good mobile application and does not offer great CFD trading tools such as vital charts and late trade execution.

Robinhood

Unlike other online stock brokers, Robinhood does not accept mutual funds trading; only stocks, ETFs, and cryptocurrency are supported. While Robinhood does not charge commissions for trading, it does profit from your business in a variety of ways.

📌 Features

- Knowing the wide variety of experience levels of traders, CMC Markets offers one of the best forex broker platforms, intuitive and powerful.

- If you are looking to buy equity funds such as ETFs or mutual funds, it is helpful to have a broker who can select the best options.t.

- It offers low commission-free brokerage, but if you live outside of the US and want to trade in other stock markets, you will need to check which local brokers charge you to trade stocks.

- Discount brokers are better for those who are looking for a cheaper option but are willing to learn and stay more practical with their accounts.

🤑 Pricing

Although Robinhood does not charge its customers directly for trades, it is largely funded by market makers and frequency trading businesses who pay for the order flow generated by its retail traders. Robinhood also gets money through interest on securities and margin loans.

Pros and Cons

Pros 👍

- Robinhood succeeds at being simple to use and inexpensive, and as a secondary or third account, it makes trading more casual and enjoyable

- It is not bad for novices with a few dollars set up to spend money to learn.

Cons 👎

- The website’s design and operation are both great.

- Robinhood generates revenue by selling customer information.

- Customer service is weak.

Webull

Webull is controlled by Fumi Technology, a Chinese investment group backed by Xiaomi, Shunwei Capital, and other Chinese private equity investors.

📌 Features

- Webull is one of the more recent online brokers, having been founded in 2017 and debuting with only a mobile app in May 2018.

- This mobile-first launch reflected Webull’s primary target market: millennials. Webull is positioned itself to accommodate newer and more active traders, as well as those who are lured to a platform.

🤑 Pricing

Webull provides among of the lowest brokerage costs while yet providing powerful trading tools. Despite its modest fees, it may not be the ideal brokerage for newcomers. The investment information on this website is offered only for educational purposes.

Pros and Cons

Pros 👍

- There are no fees for stocks/ETFs, options, or cryptocurrencies.

- Simple account setup and option approval, as well as no fees or minimums

Cons 👎

- There is no revenue from surplus cash.

- Due to payment for order flow, there is a chance that execution may be abandoned (PFOF).

- Limited range of tools for portfolio management

Charles Schwab

Charles Schwab offers a diverse range of tradable instruments, including mutual funds, exchange-traded funds (ETFs), index funds, bonds, options, and futures. However, unlike several comparable firms, it does not provide currency trading.

📌 Features

- In addition to ease of use and a robust educational library, it offers excellent customer service, with several ways to access its customer service options.

🤑 Pricing

Schwab Stock Slices provide access to fractional shares, allowing investors to purchase a little portion of a stock rather than the entire share price. Similar brokers that provide fractional trading, such as Fidelity and Interactive Brokers, do not have similar limitations.

Pros and Cons

Pros 👍

- Quotes in real time for free.

- Platforms that are simple to use and include outstanding content and resources

- Access to extended hours and pre-market trading

Cons 👎

- Inadequate Cryptocurrency Trading Management.

- Fees for Standard Services

- Customer Account Types are Limited. There is no access to the bond market.

🔥 Which One Is The Best?

One of the easiest methods for novice investors to get started in the stock market is to establish an online investment portfolio, which can be used to engage in stock holdings or stock mutual funds. Many brokerage accounts allow you to make an investment for the price of a small share. Robinhood is great as compared to others.

FAQs

What is the purpose of a trading platform?

Many financial systems allow you to create custom alerts and watchlists for volatile markets. In this manner, you may be alerted about markets that you believe will provide you with returns. As trading using real-time quotations, you may immediately push the buy or sell button when the price reaches your aim.

Which type of trading is the most profitable?

In the case of stocks, traders want variance, trading volume, and trending trades. Although it is difficult to say that one style of trading is more profitable than another but day trading is good.