Are you tired of using eToro and looking for something different? 😪

Many people want more choices, lower costs, or better tools when they trade. Whether you’re new to trading or have lots of experience, picking the right platform is important. ✅

Let’s check out the best alternatives to eToro that offer cool features and new chances to do well in trading. 💥

Table of Contents

🏆 4 Great Alternatives to eToro for Easy Trading

| Feature | TradingView | Ameritrade | E*Trade’s | UPHOLD |

|---|---|---|---|---|

| Asset Diversity | Wide range including stocks, forex, cryptocurrencies, futures | Diverse options including stocks, options, ETFs, and more | Stocks, ETFs, options, mutual funds, bonds, and bonds | Cryptocurrencies, traditional currencies, precious metals, stocks, and more |

| Charting Tools | Advanced charting tools with customizable indicators and drawing tools | Powerful research and analysis tools, including thinkorswim platform | Intuitive platform with customizable dashboard and streaming market data | Basic charting tools |

| Direct Asset Ownership | No | Yes | Yes | Yes |

| Educational Resources | Extensive community with trading ideas and insights | Comprehensive educational resources and tutorials | Beginner-friendly guides and tools | Limited resources |

| Customer Support | Limited | 24/7 customer support | 24/7 customer support | Email support |

TradingView

TradingView is a cool choice instead of eToro, especially if you like looking at charts and analyzing markets.

It’s awesome for traders who want to get deep into seeing how prices move and finding chances to buy or sell.

TradingView has some of the best tools for drawing and looking at charts, helping you spot where the market might go next.

Plus, there’s a big community of traders on TradingView sharing tips and ideas. While eToro is good for copying others’ trades, TradingView is better if you want to make your own choices based on your research.

It’s great for anyone wanting to get better at trading by doing their homework.

📌 #4 Unique Features

📍 Better Chart Tools: TradingView has lots of cool chart tools that let you look at the market in many ways. You can draw on charts, use lots of indicators, and really customize how you see things.

📍 More Markets to Explore: It gives you access to a lot more than just stocks or crypto. You can look at many different things like Forex (currency trading), futures, and indexes from all over the world.

📍 Make Your Own Analysis Tools: On TradingView, you can create your own tools to help decide when to buy or sell. It’s like making your own trading helper using their special coding language.

📍 Learn and Share with Others: TradingView has a big community where people share their trading ideas and tips. It’s more about learning from detailed charts and strategies than just copying someone else’s trades, like on eToro.

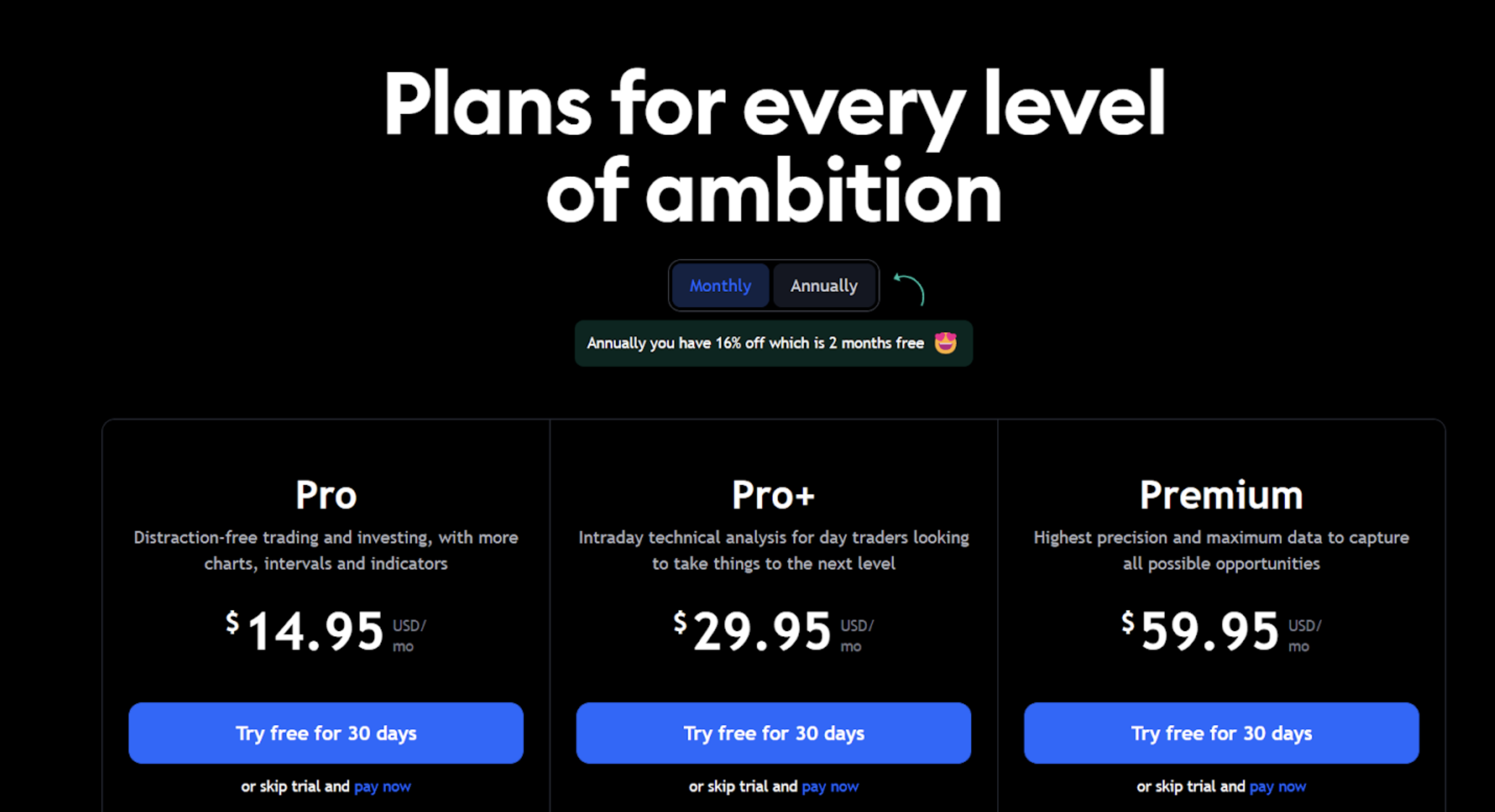

🤑 Pricing

Here’s a comparison table for the Essential, Plus, and Premium plans based on the features and pricing details you provided:

| Feature/Plan | Essential | Plus | Premium |

|---|---|---|---|

| Monthly Price | $14.95 | $29.95 | $59.95 |

| Annual Price | $155.40 | $299.40 | $599.40 |

| Annual Savings | $24.00 | $60.00 | $120.00 |

| Free Trial | 30 days | 30 days | 30 days |

| Charts per Tab | 2 | 4 | 8 |

| Indicators per Chart | 5 | 10 | 25 |

| Historical Bars | 10K | 10K | 20K |

| Price Alerts | 20 | 100 | 400 |

| Technical Alerts | 20 | 100 | 400 |

| Parallel Chart Connections | 10 | 20 | 50 |

Ameritrade

Ameritrade is a great pick if you’re looking for more than what eToro offers. It’s packed with different things to invest in, like stocks, bonds, and funds, which is perfect if you want to mix up your investments.

Plus, Ameritrade is awesome for learning how to trade better. They have loads of easy-to-understand guides and tools that help you figure out the market on your own.

While eToro is cool for following what others do, Ameritrade gives you everything you need to make your own smart choices, especially if you’re into digging into research and planning for the long run.

📌 #4 Unique Features

📍 Cool Trading Software: Ameritrade gives you access to thinkorswim, a really powerful tool for trading that lets you do deep dives into the market, practice with fake money, and get real-time market data.

It’s great for trying out tricky trading moves without risking real cash.

📍 Free Fancy Tools for Everyone: With Ameritrade, you don’t have to pay extra to use their fancy trading tools and software.

They offer advanced charting and analysis tools for free, helping you make smarter trading decisions whether you’re new or have lots of experience.

📍 Lots of Things to Invest In: Ameritrade lets you invest in more stuff than eToro, like options, futures, forex (currency trading), and bonds.

This means you can spread your investments over different kinds of things, which can be safer and more fun.

📍 Help Anytime You Need It: Ameritrade is there for you 24/7 if you have questions or run into problems.

This means you can get help anytime, day or night, which is super handy if you’re trading at odd hours or just need quick answers.

🤑 Pricing

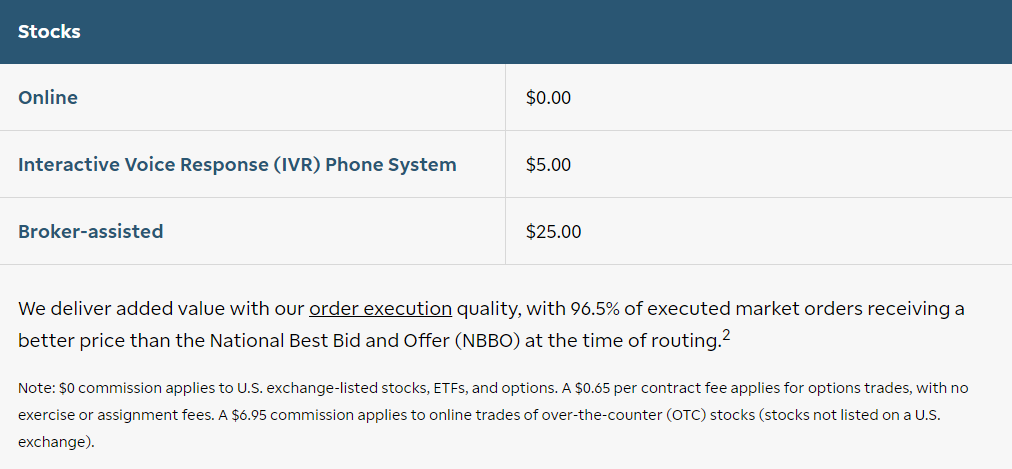

| Service Option | Price |

|---|---|

| Online | $0.00 |

| Interactive Voice Response (IVR) Phone System | $5.00 |

| Broker-assisted | $25.00 |

Must Read: 7 Best Trading Platform: 2nd One Is The Best

ETrade’s

ETrade’s website is a great pick if you’re thinking of switching from eToro. It’s super easy to use, even if you’re new to trading.

ETrade gives you lots of investment choices like stocks and ETFs, plus all the info and tools you need to make smart decisions. Unlike eToro, which is all about following other traders,

ETrade helps you learn with guides and tips for every level, from beginner to pro. So, if you want a simple way to trade on your own and get lots of help learning how, ETrade could be just what you’re looking for.

📌 #4 Unique Features

📍 Your Personalized Dashboard: With E*Trade, you can set up your dashboard just how you like it.

This means you can keep an eye on the stuff that matters most to you, like your favorite stocks or market trends.

📍 Know Your Risks: E*Trade helps you understand how risky your trades might be with special tools.

These tools give you a heads-up on the possible rewards and risks of your investments, which can be really handy, especially if you’re trading options.

📍 Practice with Fake Money: It lets you practice trading without risking real cash. You can use their virtual trading simulator to try out different strategies and get the hang of things before jumping in with real money.

📍 Stay Updated on the Market: Gives you live updates on what’s happening in the market and even streams CNBC live.

This means you’ll always be in the loop with the latest news and trends, helping you make smarter trading decisions.

🤑 Pricing

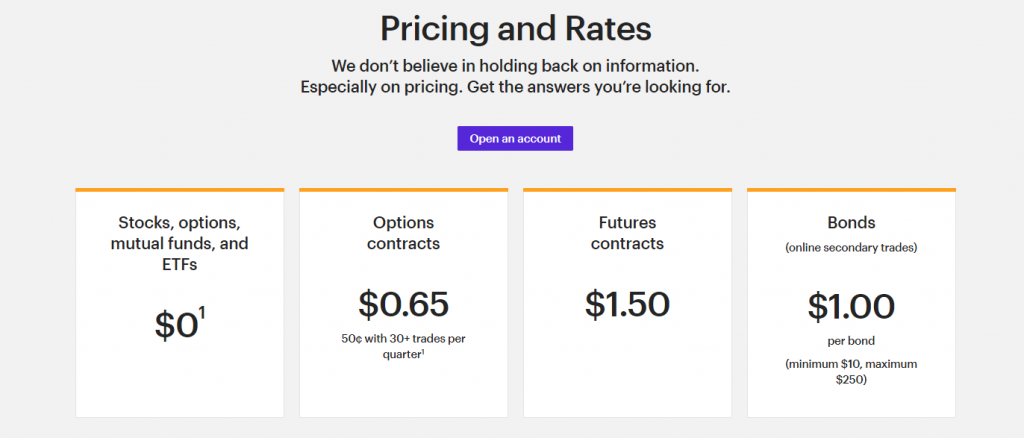

| Investment Type | Price | Additional Information |

|---|---|---|

| Stocks, options, mutual funds, ETFs | $0.01 | |

| Options contracts | $0.65 | $0.50 with 30+ trades per quarter |

| Futures contracts | $1.50 | |

| Bonds (online secondary trades) | $1.00 per bond | Minimum $10, Maximum $250 |

Also Read: Best TradingView Alternatives: Why You Should Choose This?

UPHOLD

UPHOLD is another option if you’re thinking about switching from eToro. It’s a place where you can easily buy and sell lots of different things like cryptocurrencies, regular money, and even precious metals.

Unlike eToro, which is more about copying other traders, UPHOLD is all about straightforward trading. It’s easy to use and has clear fees, so you always know what you’re paying.

Plus, UPHOLD takes security seriously, so you can trust your investments are safe. If you’re into trading cryptocurrencies or want more control over your investments, UPHOLD could be a great alternative to eToro.

📌 #4 Unique Features

📍 Direct Asset Ownership: UPHOLD allows users to directly own the assets they purchase, including cryptocurrencies like Bitcoin and Ethereum.

Unlike eToro, where users trade Contracts for Difference (CFDs) without owning the underlying assets, UPHOLD’s approach ensures users have full control and ownership of their investments.

📍 Wide Range of Supported Assets: Offers a broader selection of assets beyond cryptocurrencies, including traditional currencies, commodities like gold and silver, and even stocks.

This diverse range of options provides users with more opportunities for portfolio diversification compared to eToro’s primarily stock and crypto-focused offerings.

📍 Transparent Fee Structure: Boasts a transparent fee structure, with fees clearly outlined for each transaction.

In contrast, eToro’s fee structure can be more complex, with additional fees for withdrawals, inactivity, and currency conversion, leading to potential confusion for users.

📍 Global Availability: Available to users worldwide, allowing individuals from different countries to access its platform and trade various assets.

This global accessibility sets UPHOLD apart from eToro, which has restrictions on access for users from certain countries due to regulatory reasons or limited availability of certain assets.

🤑 Charges

| Asset Type | Transaction Fee |

|---|---|

| Stablecoins and major market FX | 0.25% |

| BTC, ETH | 1.4% – 1.6% |

| Altcoins | 1.9% – 2.5% |

| Precious Metals | 1.9% – 2.5% |

🪽 5 Essential Considerations When Choosing an eToro Alternative

📍 Consider Asset Diversity

Unlike eToro, which primarily focuses on stocks and cryptocurrencies, look for alternatives like UPHOLD or Ameritrade that offer a wider range of assets such as commodities, forex, and options.

This ensures you have more options for diversifying your portfolio beyond what eToro provides.

📍 Evaluate Fee Structures

Unlike eToro, which may have hidden fees and higher withdrawal charges, prioritize alternatives with transparent fee structures like TradingView or E*Trade.

This helps you avoid unexpected costs and ensures that your investment returns are not eroded by excessive fees.

📍 Review User Control

Unlike eToro, where users trade CFDs and do not own the underlying assets, prioritize alternatives like UPHOLD or Coinbase that allow direct ownership of assets.

This gives you more control over your investments and eliminates the risks associated with trading CFDs.

📍 Assess Educational Resources

Unlike eToro, which may lack comprehensive educational materials for traders, opt for alternatives like TD Ameritrade or TradingView which offer extensive educational resources.

This ensures that you have access to the knowledge and tools needed to make informed trading decisions.

📍 Check Customer Support

Unlike eToro, which may have limited customer support options, choose alternatives like E*Trade or UPHOLD which offer reliable customer support services.

This ensures that you can get assistance whenever you encounter issues or have questions about your trading activities.

Also Read: TradingView vs. TrendSpider: Top Performer?

🔥 Bottom line

In conclusion, exploring alternatives to eToro presents exciting opportunities for traders seeking more diverse investment options, transparent fee structures, direct asset ownership, comprehensive educational resources, and reliable customer support.

Each alternative platform offers unique features and advantages over eToro’s limitations, catering to different trading preferences and needs.

Whether it’s TradingView’s robust charting tools, Ameritrade’s extensive market coverage, E*Trade’s user-friendly interface, or UPHOLD’s wide range of supported assets, traders have plenty of options to choose from.

By carefully considering the essential factors outlined above, individuals can make informed decisions to enhance their trading experience and achieve their financial goals.